AI vs. Traditional CMA Methods: How to Price Listings in 2026 Without Losing Your Mind

I’ll be straight with you—I spent my first three years in real estate thinking that spending entire Sundays buried in spreadsheets was just “part of the job.” I’d pull comps, cross-reference tax records, and manually adjust for every little difference between properties. My wife used to joke that I was married to my laptop.

Then one day, a newer agent in my office closed three listings in the time it took me to finish one CMA. That was my wake-up call.

The way we price homes is changing, and if you’re still doing everything the old way, you’re not being thorough—you’re just being slow. This isn’t about choosing between experience and technology. It’s about using both intelligently so you can actually have a life outside of work.

Contents

- 1 The Reality Check: What Traditional CMAs Actually Cost You

- 2 How AI Actually Works in Real Estate Valuation

- 3 The Hybrid Approach: How I Actually Work Now

- 4 From Data to Presentation: The Client Experience

- 5 What to Expect in 2026 and Beyond

- 6 Practical Implementation: What Actually Works

- 7 Common Concerns and Real Answers

- 8 Moving Forward: Your Action Plan

- 9 Final Thoughts

The Reality Check: What Traditional CMAs Actually Cost You

The Time Sink Nobody Talks About

Let me walk you through what a traditional CMA used to look like for me. I’d start by pulling 6-8 comparable sales from the MLS—that’s the easy part. Then came the detective work: verifying sale dates, checking if any were short sales or foreclosures, confirming the actual condition of each property.

For one listing last year, I spent two hours discovering that what the MLS listed as “updated kitchen” was actually a cosmetic flip from 2015 with builder-grade everything. That kind of detail matters when you’re justifying a price to a seller.

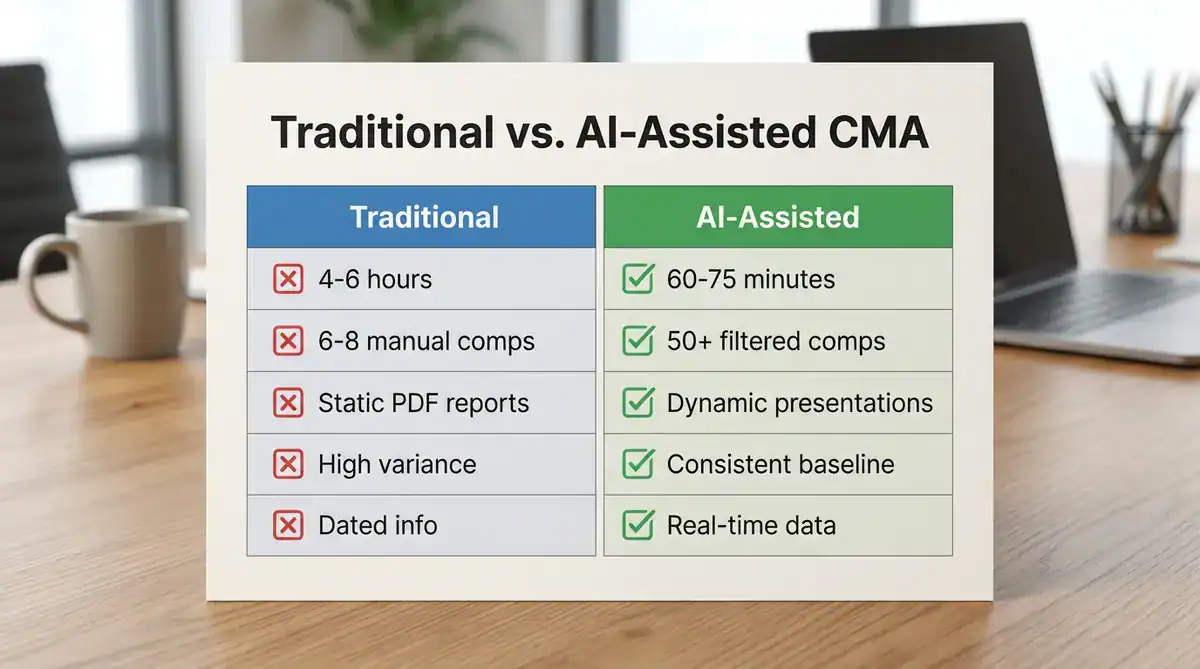

The industry standard says these deep-dive CMAs take anywhere from 3-7 days for complex properties. Even a straightforward residential comp analysis eats up 4-6 hours when you factor in drive-bys, research, and putting together a presentation that doesn’t look like a tax document.

Where Human Bias Creeps In

Here’s something I had to admit to myself: my personal feelings were affecting my pricing. I consistently undervalued homes in neighborhoods where I’d had difficult transactions. Meanwhile, I was probably too optimistic about properties in areas where I’d had great experiences.

One seller called me out on this. She had gotten a second opinion, and my pricing was 8% lower than another agent’s—not because of the data, but because I’d mentally written off her street based on one bad buyer from years ago. That was embarrassing and expensive for both of us.

The Opportunity Cost

Every hour I spent adjusting square footage calculations was an hour I wasn’t prospecting, nurturing leads, or actually showing homes. When you’re averaging 15-20 CMAs a month (between serious prospects and courtesy valuations), that’s 60-120 hours of research time. That’s three full work weeks.

Do the math on what your time is worth, and suddenly those “free CMAs” aren’t looking so free.

How AI Actually Works in Real Estate Valuation

Beyond the Automated Valuation Model (AVM)

Most people think “AI valuation” means those Zillow estimates that are somehow always wildly optimistic or depressingly low. That’s not what we’re talking about here.

Modern AI tools for agents work differently. They’re pulling from the same MLS data you access, but they’re processing thousands of variables simultaneously. Where I might manually compare 6-8 comps, these systems are analyzing 50-100 properties, then filtering down to the most relevant matches based on dozens of criteria.

What the Algorithms Actually See

The capabilities have gotten genuinely impressive. I tested one platform that analyzed listing photos to identify renovation quality—it could tell the difference between a contractor-grade kitchen remodel and a DIY job. It picked up on backsplash materials, cabinet hardware, and even flooring quality.

Some systems now use satellite imagery to assess lot characteristics, neighborhood density, and proximity to amenities. They’re tracking market velocity—how quickly homes are selling in specific price bands and locations. They’re monitoring DOM (days on market) trends and inventory levels in real-time.

But here’s what’s actually useful: these tools give you a statistically sound starting point in about 90 seconds. That’s not a final answer—it’s a foundation you can build on.

The Accuracy Question Everyone Asks

“Can AI smell the cat pee?”

I get asked this constantly, and the answer is no. AI also can’t detect that the neighbors have a perpetually barking dog, that there’s a weird echo in the master bedroom, or that the street gets uncomfortably loud during school drop-off.

For standard subdivision homes—your typical three-bedroom ranches or two-story colonials—AI valuations are remarkably accurate, usually within 2-3% of final sale price. That’s better than many appraisers on first pass.

But for unique properties, rural land, luxury homes, or anything with character (good or bad), you still need boots on the ground. The AI gives you the quantitative analysis; you provide the qualitative assessment.

The Hybrid Approach: How I Actually Work Now

My Current Workflow

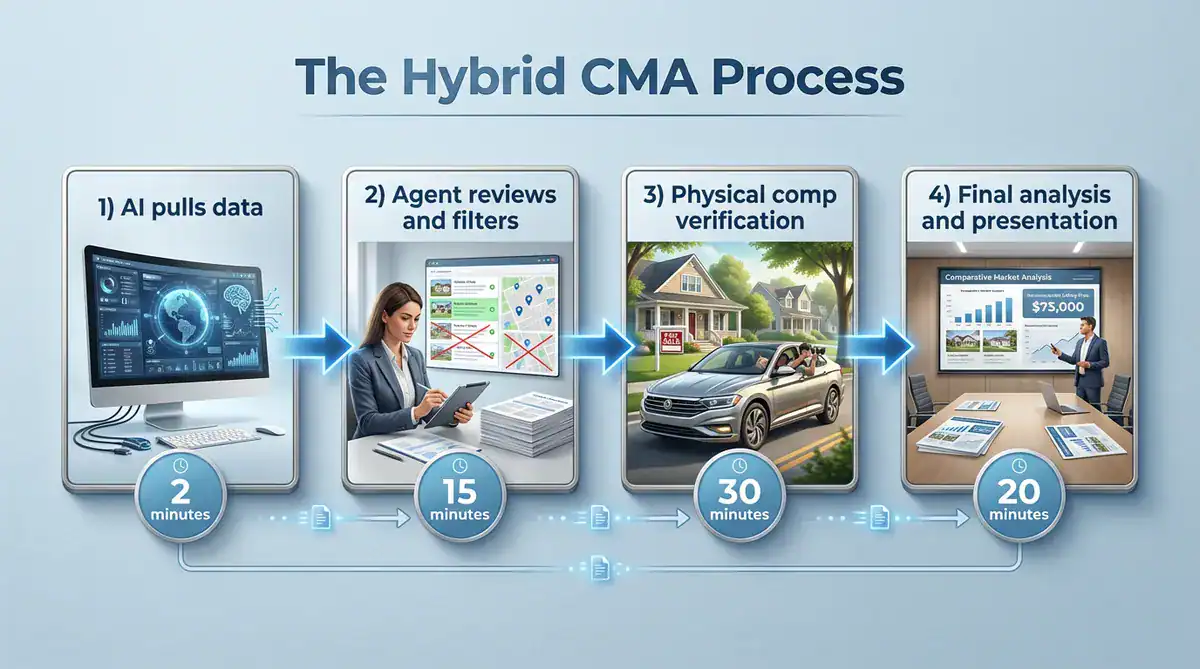

Here’s what changed in my practice. When a seller inquiry comes in, I immediately run it through an AI-powered CMA tool. Within two minutes, I have:

- A baseline valuation range

- 15-20 comparable sales, automatically filtered by relevance

- Market trend data for that specific area

- Estimated days on market based on current conditions

Then I do what only I can do: I drive by the property and the top 5-6 comps. I look at the neighborhood dynamics. I factor in my knowledge of pending developments, school boundary changes, or upcoming infrastructure projects that might not be in any database yet.

Where I Add Value

The AI handles the data aggregation—that’s the tedious part I don’t miss at all. My value comes from interpretation and context.

For example, I recently priced a home that the AI pegged at $485K. The comps supported that number perfectly on paper. But when I drove the neighborhood, I noticed that three homes on the street had recently been bought by investors who were doing significant renovations. That’s a signal of neighborhood appreciation that wouldn’t show up in historical data yet. We listed at $499K and got $505K.

The opposite happened too. AI suggested $340K for a townhome based on recent sales. But I knew that the HOA had just hit everyone with a special assessment for $15K due to roof repairs. We priced at $325K to account for that, and the buyer’s agent later told me that pricing realism is why their client chose to make an offer.

Time Savings That Actually Matter

My CMAs now take about 60-75 minutes from start to finish, including the drive-by. That’s an 80% time reduction. But more importantly, the quality is better because I’m not mentally exhausted from data entry when I get to the analysis part.

I can now handle 30-35 CMA requests per month without weekend work. That’s lead volume I simply couldn’t serve before without hiring an assistant.

From Data to Presentation: The Client Experience

What Sellers Actually Want to See

I learned this the hard way: sellers don’t care about your process. They care about results and reassurance.

Handing someone a stack of printouts with highlighted numbers doesn’t build confidence anymore. They’ve already seen the Zillow estimate. They’ve looked at Redfin. They want to know why they should trust your number over the algorithm they can access for free.

The Presentation Evolution

This is where things get interesting. Once you have good data, you need to communicate it effectively. The gap between “having the right price” and “getting the listing” is often about presentation.

I started using digital presentations instead of paper reports about 18 months ago. Instead of static charts, I show dynamic comparisons. I walk sellers through an iPad presentation that includes:

- Interactive maps showing where comps are located

- Side-by-side photo comparisons

- Market trend graphs that actually mean something

- A pricing strategy range with predicted outcomes for each

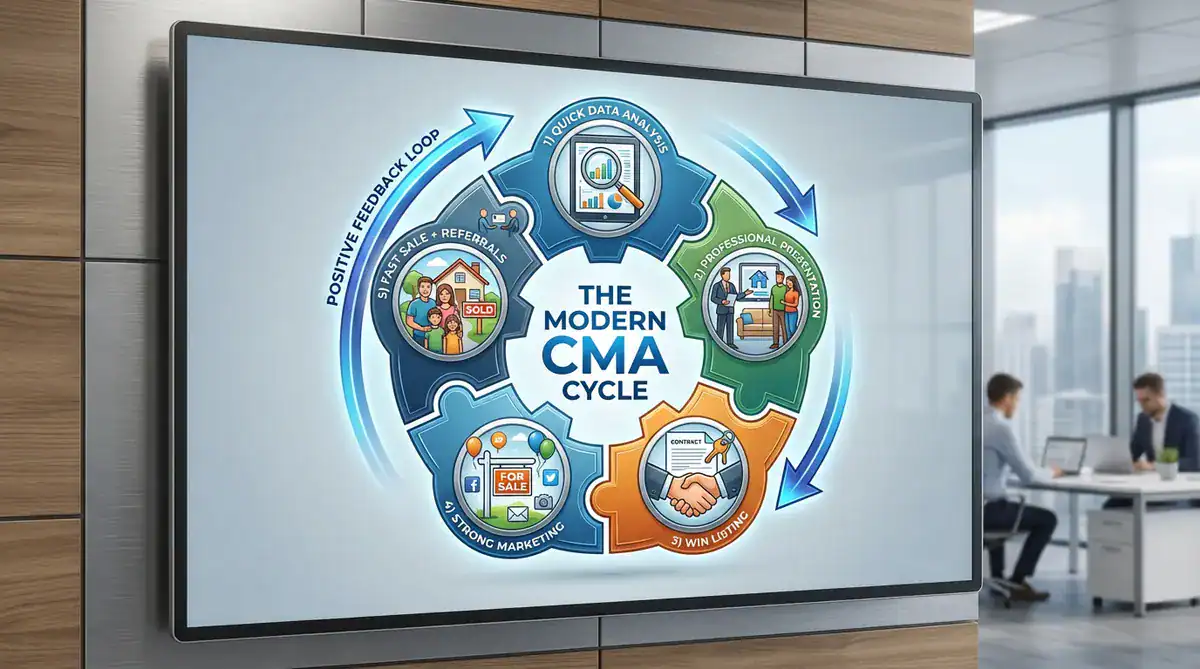

The conversion rate difference was immediate. I went from signing maybe 60% of CMAs to closing about 80%.

The Marketing Connection

Here’s something that took me too long to figure out: the CMA process is your first marketing piece. If your pricing presentation looks professional and modern, sellers assume your listing marketing will be too.

Some newer platforms let you transform CMA data into actual marketing content—property videos, social media graphics, listing descriptions. I’m not talking about auto-generated garbage, but professionally formatted content that uses your valuation data as the foundation.

The time I save on research now goes into creating better marketing, which helps homes sell faster, which proves my pricing was right, which gets me more referrals. It’s a positive cycle.

What to Expect in 2026 and Beyond

Real-Time Valuation Updates

The market is moving toward instant updates. Interest rates change, inventory levels shift, and suddenly pricing assumptions from last week don’t hold.

I’m already seeing platforms that monitor your active listings and send alerts when market conditions suggest a price adjustment. Imagine telling a seller on day 30: “Interest rates dropped half a point this week, and buyer activity in your price range just increased 15%. We should increase your price by $10K.” That’s the kind of proactive service that builds trust.

The Agent’s Evolving Role

Let me be clear about something: AI is not replacing agents in pricing. But it is changing what sellers expect from us.

They don’t need us to pull tax records—they can do that themselves. They need us to interpret market psychology, to understand buyer motivations, to position their home strategically. That requires experience and emotional intelligence, not spreadsheet skills.

The agents who resist this shift are the ones who’ve built their identity around being “the data person.” If your main value proposition is “I work really hard on research,” you’re in trouble. The new value proposition is “I work really smart and get results.”

Adapting Without Losing Your Mind

The transition doesn’t have to be overwhelming. Start small:

Month 1: Try an AI tool for just your routine CMAs (courtesy valuations, sphere check-ins). Keep doing high-stakes listings the old way if that makes you comfortable.

Month 2: Start using AI for listing presentations, but verify everything manually as a double-check.

Month 3: Let the AI do the heavy lifting, focus your energy on the interpretation and presentation.

Most agents I know who’ve made this shift say the same thing: they wish they’d started sooner.

Practical Implementation: What Actually Works

Choosing the Right Tools

I’m not going to pretend there’s one perfect solution. Your brokerage might provide tools. You might prefer standalone platforms. What matters is finding something that integrates with your MLS and doesn’t require a computer science degree to use.

Look for platforms that:

- Pull directly from MLS data (no manual entry)

- Allow manual adjustments (you need to override the AI when necessary)

- Generate client-ready presentations (not just spreadsheets)

- Provide mobile access (you should be able to pull a quick comp at a showing)

Most robust options run $40-100 per month. When you calculate the time savings against your hourly value, the ROI is typically immediate.

The Verification Step You Can’t Skip

Here’s my non-negotiable rule: for any listing over $500K or anything unique, I still drive by the top comps. I learned this after an AI tool suggested a comp that looked perfect on paper—similar size, same neighborhood, recent sale.

When I drove by, the comp was on a busy road with commercial traffic. My listing was in a quiet cul-de-sac three blocks away. That location difference was worth $40K, but it wasn’t reflected in the raw data.

Trust but verify. Always.

Training Your Sellers

One unexpected benefit: using AI tools makes it easier to educate sellers about pricing.

When I used to just tell someone their home was worth $450K based on “comparable sales,” some sellers would push back or second-guess. Now I can show them exactly how the system weighted different factors, which comps were most relevant, and why.

It depersonalizes the pricing discussion. It’s not “me versus seller” anymore—it’s “here’s what the data shows, and here’s how I’m interpreting it based on factors the algorithm can’t see.”

Common Concerns and Real Answers

“Will this make me look less expert?”

Actually, the opposite. When you can instantly pull comprehensive market data and explain your reasoning clearly, you look more professional, not less.

What makes you look amateur is showing up unprepared or giving pricing that’s clearly based on guesswork. Using professional tools is expected in 2026, just like having a website was expected in 2010.

“What about rural or unique properties?”

This is where the hybrid model really matters. AI struggles with rural land, historic homes, luxury properties, or anything that doesn’t fit standard patterns.

For these listings, I still do extensive manual research. But even here, AI helps by pulling the initial data set and identifying outliers. I just spend more time on the adjustment phase.

“Is this actually worth the subscription cost?”

I track this obsessively because I’m naturally cheap. My time savings averages 3.5 hours per CMA. At 25 CMAs per month, that’s 87.5 hours saved. Even if only half those CMAs turn into listings, the ROI is massive.

But beyond time savings, the professional presentation quality has directly led to signed listing agreements. I can point to specific instances where sellers told me they chose me because my presentation “felt more legitimate” than other agents.

Moving Forward: Your Action Plan

Start This Week

Pick one upcoming CMA and run it through an AI tool alongside your normal process. Compare the results. See where the AI nailed it and where you had to make adjustments. This will give you confidence in where you can trust the technology and where you need to stay hands-on.

Focus on Presentation

Even if you’re not ready to change your research process, upgrade how you present pricing to sellers. Turn your Word document CMA into a PDF with photos and charts. Use your tablet instead of printouts. Small changes make a big difference in perceived professionalism.

Build Your Feedback Loop

After every listing, note where your pricing was accurate and where it needed adjustment. Track which factors the AI missed versus which ones you missed. Over time, you’ll develop an instinct for when to trust the automation and when to dig deeper.

Stay Human

Technology should amplify your expertise, not replace your judgment. The agents who succeed in 2026 will be the ones who use AI to handle the tedious work so they can focus on the relationship work.

Your seller doesn’t want to hire a data analyst. They want to hire a trusted advisor who understands their goals, communicates clearly, and gets results. Use technology to free up the mental space to be that person.

Final Thoughts

I don’t miss Sunday nights drowning in spreadsheets. I don’t miss the anxiety of wondering if I missed a crucial comp. And I definitely don’t miss losing listings because my presentation looked like homework from 2005.

The divide between traditional and AI-assisted pricing isn’t about old agents versus new agents. It’s about agents who adapt versus agents who dig in. The technology exists. The question is whether you’ll use it to work smarter or keep working harder.

The market in 2026 won’t wait for you to figure this out. Sellers have more options, more information, and higher expectations than ever before. Meeting those expectations while maintaining your sanity requires leveraging the best tools available.

Start small. Test carefully. But start. Your future self—and your family—will thank you for getting those Sunday nights back.