How to Actually Price a Home in 2026 Market: A Real Estate Agent’s Honest Guide

Look, I’ll be straight with you. After years of helping clients buy and sell homes, the number one question that causes the most stress isn’t about staging or marketing—it’s “what should we price this at?” And I get it. Price too high, and your listing sits there collecting dust while buyers scroll past. Price too low, and you’re leaving money on the table. Neither feels good.

So let me share what I’ve learned from both my wins and my mistakes when it comes to pricing homes. This isn’t theory from a textbook—it’s what actually works in real neighborhoods with real buyers.

Contents

- 1 Why Pricing Feels Like Guesswork (But Doesn’t Have To Be)

- 2 The Foundation: Understanding What Comparable Sales Really Mean

- 3 Current Market Conditions: Reading the Room

- 4 The Pricing Strategy That Works

- 5 Advanced Considerations Most Agents Miss

- 6 Technology’s Role (Without the Sales Pitch)

- 7 Red Flags That Your Price Is Off

- 8 The Conversation I Have With Every Seller

- 9 When to Adjust (And When to Stay the Course)

- 10 What This All Means for You

Why Pricing Feels Like Guesswork (But Doesn’t Have To Be)

Here’s something most agents won’t admit: pricing is part science, part art, and part psychology. You can run all the numbers you want, but at the end of the day, a home is worth what someone’s willing to pay for it. That said, we’re not just throwing darts at a board here.

The problem is that sellers often have an emotional attachment to their home. They remember what they paid, what they’ve invested in upgrades, and what their neighbor’s cousin’s house sold for three years ago. Buyers, on the other hand, are comparing your listing to everything else available right now—and they’re ruthless about it.

My job? Finding that sweet spot where market reality meets seller goals.

The Foundation: Understanding What Comparable Sales Really Mean

What Actually Makes a Home “Comparable”

Everyone talks about “comps,” but let me tell you what really matters. I’m not just looking at any three-bedroom house within a mile radius. I’m getting specific:

Location specifics matter more than you think. A house on a cul-de-sac sells differently than one on a busy street, even if they’re in the same neighborhood. School boundaries can create a $50K price difference within blocks.

Condition isn’t just “good” or “bad.” There’s a massive difference between a kitchen that’s dated but functional and one that needs a complete gut job. I’m looking at homes that match your property’s actual condition, not just its bones.

Timing is everything. I weight recent sales more heavily because the market shifts. What sold six months ago might be interesting context, but what’s closing this month? That’s your real competition.

The Data Points I Actually Use

Square footage is just the starting point. I’m calculating price per square foot, but I’m also noting:

- How functional is the layout? Open concept vs. choppy rooms changes everything.

- What’s the lot size and usability? A quarter-acre that’s flat and fenced beats a half-acre on a steep slope for most buyers.

- Updates and upgrades—but realistic ones. Your $30K kitchen remodel might add $15K in value. Maybe.

- Days on market for those comps. If everything’s selling in a week, we’re in different territory than if homes are sitting for 60 days.

Current Market Conditions: Reading the Room

The Metrics That Tell the Real Story

I check the hyperlocal data weekly because markets can shift neighborhood by neighborhood. Here’s what I’m tracking:

Inventory levels in your specific price range. Total market inventory doesn’t matter as much as how many homes are competing directly with yours. If there are fifteen similar homes available and only two sold last month, that’s a buyer’s market for your property type—even if the overall market is balanced.

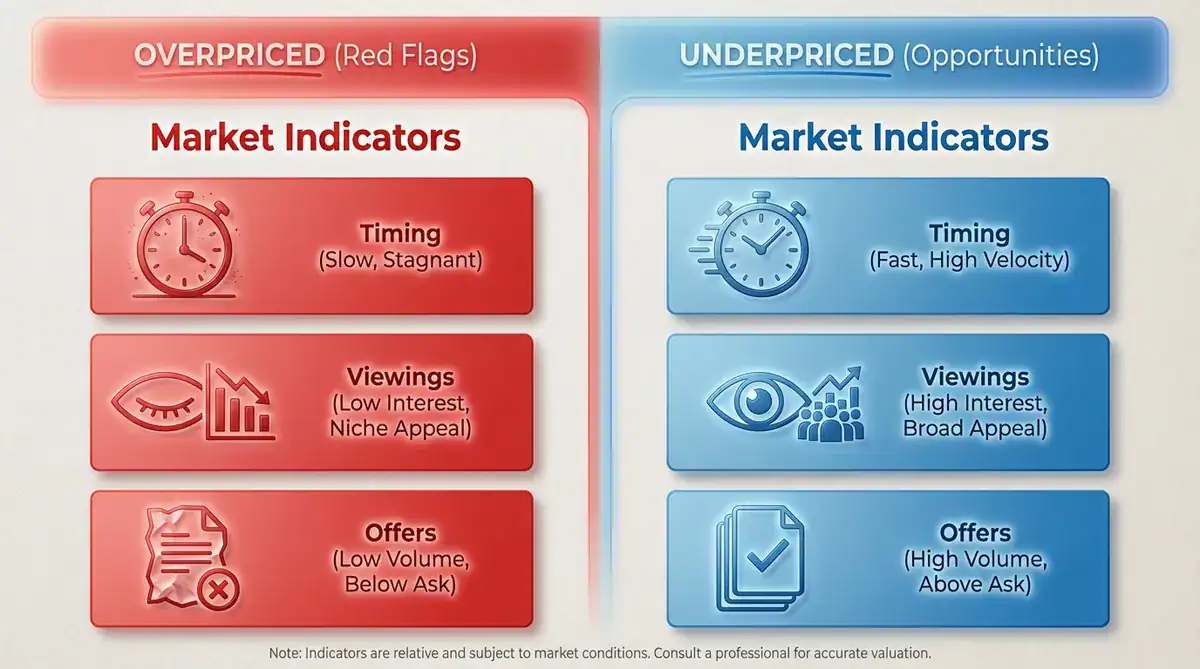

Average days on market. This tells me how aggressive we can be. Under 30 days? We might have room to test the high end. Over 60? We need to be competitive from day one.

List price to sale price ratios. Are homes selling above asking (multiple offers), at asking (balanced), or below (buyer negotiations)? This happened to me last spring—homes were listing at $X and selling for 5% more. That changes everything about strategy.

Seasonal and Economic Factors

Spring isn’t always the best time to sell, despite what everyone says. I’ve had listings do incredibly well in January because there was less competition and the buyers looking were serious.

Interest rates affect your pricing more than you might realize. When rates jump, buyer purchasing power drops, which means price expectations need to adjust. It’s not fair, but it’s reality.

The Pricing Strategy That Works

Starting With a Competitive Range

I never give sellers a single number. Instead, I present a range based on different scenarios:

Conservative pricing: This is the “it’ll definitely sell” number. It’s based on the lower end of comps and assumes normal market time. For risk-averse sellers or those with timing pressure, this makes sense.

Market-value pricing: This is where most similar homes have been selling. It’s my recommended starting point about 70% of the time. You’re competitively positioned to attract serious buyers without leaving money behind.

Aspirational pricing: Sometimes, if a property has unique features or we’re in a hot micro-market, we might test slightly above. But I’m honest about the risk—you might sit longer or need to reduce.

The Danger of “Testing the Market”

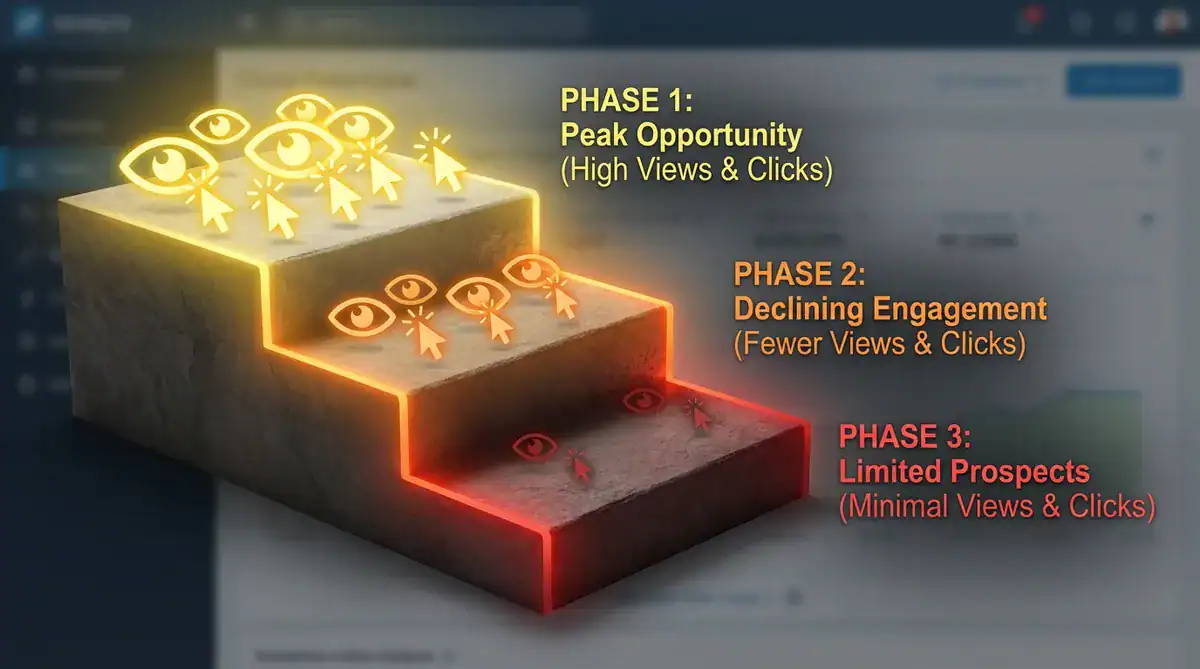

I’ve had sellers want to “try” a high price and “see what happens.” Here’s what happens: your listing gets the most attention in the first two weeks. If you’re overpriced during that window, you’ve wasted your best opportunity. By the time you reduce, buyers wonder what’s wrong with the house.

The data backs this up. Homes priced right from the start sell for more on average than homes that start high and reduce. It’s counterintuitive, but true.

Advanced Considerations Most Agents Miss

The Appraisal Factor

Here’s something crucial: even if a buyer loves your home and offers your asking price, their lender will order an appraisal. If your price isn’t supported by comps, the deal can fall apart or require renegotiation.

I’ve learned to price with the appraiser in mind. Can I clearly justify this number with solid comps? If I’m stretching, there better be documentable reasons.

Unique Properties Need Different Approaches

Not everything fits neatly into the comparable sales model. Waterfront homes, properties on large acreage, or houses with unique features—these need adjusted strategies.

For unusual properties, I look at:

- The absorption rate for similar property types

- Buyer pool size (fewer potential buyers often means longer marketing time)

- Pricing at a psychological threshold that captures the right audience

Neighborhood Trends vs. Overall Market

Sometimes your neighborhood is trending differently than the broader market. Maybe there’s new development coming, or a major employer just opened nearby. These micro-trends matter enormously but won’t show up in general market statistics.

Technology’s Role (Without the Sales Pitch)

I’ll be honest—there are some helpful tools out there that make the pricing process more efficient. Automated valuation models (AVMs) give us a starting point, though I never rely on them exclusively. They miss the nuances that matter.

I’ve started using platforms that help compile market data faster, which means I can spend more time on analysis rather than data entry. Some tools can generate market reports or help present information to clients more clearly. They’re useful for streamlining the process, but they don’t replace experience and local knowledge.

The technology is there to support the process, not replace the judgment call.

Red Flags That Your Price Is Off

Signs You’re Priced Too High

- Lots of showings in week one, then crickets

- Buyer agents giving feedback like “great house, but overpriced for the market”

- Homes that listed after you are going under contract first

- You’re the longest-standing listing in your price range

Signs You Might Have Left Money on the Table

- Multiple offers within hours of listing

- Buyers waiving contingencies without you asking

- Appraisal comes in significantly above contract price

- Every showing results in strong interest

The goal isn’t to have the house sit or to create a bidding war—it’s to sell for fair market value in a reasonable timeframe.

The Conversation I Have With Every Seller

Before we finalize pricing, I sit down with my clients and make sure we’re aligned on priorities:

What’s your timeline? Need to sell fast? We price accordingly. Have flexibility? We might have more room to work with.

What’s your bottom line? I need to know your actual number—after commission, closing costs, and your mortgage payoff. Let’s make sure our pricing strategy gets you there.

What’s your risk tolerance? Some sellers want the guaranteed sale. Others are comfortable testing the market with the understanding we might need to adjust.

This conversation happens before we go live, not after we’ve been sitting on market for 45 days.

When to Adjust (And When to Stay the Course)

If we’re not getting traction after two weeks with good marketing, we need to talk about pricing. Not in six weeks—in two weeks.

But I don’t panic-reduce. I look at the data:

- How many showings have we had?

- What’s the feedback been?

- Has anything changed in the market?

- Are similar homes selling?

Sometimes the price is fine, but we need to adjust staging or photos. Other times, the market is telling us something we need to hear.

What This All Means for You

Pricing isn’t about picking the highest number you can justify or the lowest number to guarantee a quick sale. It’s about understanding what buyers in your market are actually doing right now and positioning your home competitively within that reality.

I’ve seen sellers leave $20K on the table by underpricing out of fear, and I’ve watched beautiful homes sit unsold for months because we started $30K too high. Both scenarios are preventable with the right approach.

The best outcomes I’ve seen happen when sellers trust the process, understand the reasoning behind the number, and commit to a strategy from day one. When we get the price right, everything else—marketing, showings, offers, negotiations—falls into place much more smoothly.

Your home is likely your largest asset. Pricing it deserves more than guesswork or wishful thinking. It deserves a solid strategy based on real data, market knowledge, and honest communication.

And that’s what I bring to the table—no BS, just what actually works in today’s market.

Working on pricing your home? The foundation is solid data and clear presentation. For sharing your listing details with potential buyers, tools like AI Listing Description Writer can help communicate your home’s value effectively, while AI CMA Report Generator can streamline comparative market analysis to support your pricing strategy.